What Best Describes Accrual in the Context of Accounting

Accrual accounting means revenue and expenses are recognized and recorded when they occur while cash basis accounting means these line items arent documented until. The accrual basis of accounting is the concept of recording revenues when earned and expenses as incurred.

Accrual Accounting Principles Compared To Cash Basis Accounting

Under the accrual basis of accounting or accrual method of accounting revenues are reported on the income statement when they are earned.

. When transactions are recorded in the books of accounts as they occur even if the payment for that particular product or service has not been received or made it is known as. The use of this approach also impacts the balance sheet where receivables or payables may be recorded even in the absence of an associated cash receipt or cash payment respectively. Accrual concept is the most fundamental principle of accounting which requires recording revenues when they are earned and not when they are received in cash and.

The accrual method is more common than the. Definition of Accruals The accounting and bookkeeping term accruals refers to adjustments that must be made before a companys financial statements are issued. When a firm follows.

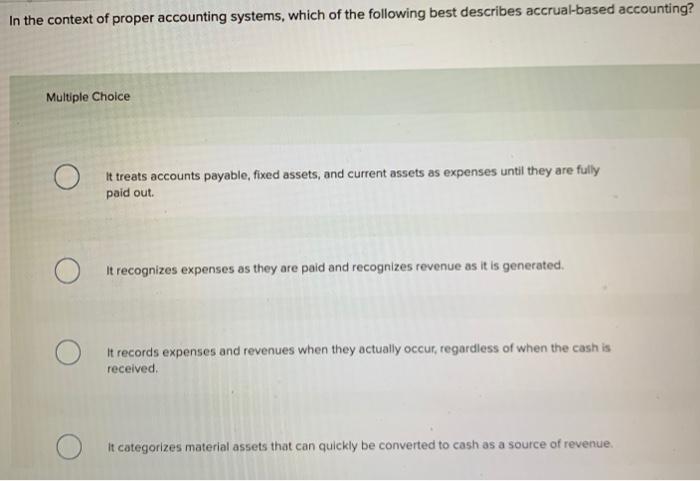

Accrual Accounting In financial accounting accruals refer to the recording of revenues that a company has earned but has yet to receive payment for and the. In short in accrual concept the recording and reporting of the transactions in the financial statements is carried out in the accounting year to which they belong. In the context of proper accounting systems which of the following best describes accrual-based accounting.

Categories in Accrual Accounting 1. However they have an impact on the firms income and assets that are based on accrual. Accrued Revenues Accrued revenues are either income or assets including non-cash assets that are yet to be received.

The accrual method of accounting is the form of accounting that records revenue when it is earned and expenses when they are incurred regardless of when its received or paid. Accounting system that recognizes expenses or revenue in the period which they occur REGARDLESS of when cash is collected or paid Regardless of when. Accrual Accounting refers to the concept in the accounting where there is the practice of recording expenses in the books of accounts of the business at the time when they are.

Accrual accounting is the opposite of cash accounting which recognizes economic events only when cash is exchanged. Accrual accounting is the recording of revenue when earned and expenses when incurred. Accrual concept of accounting requires that financial statements reflect transactions at the time when they actually occur not necessarily when cash changes the.

Accounting that refers to. The accrual basis of accounting is advocated under both generally. Under accrual basis accounting revenue is recognized when it is earned and payment is assured and the accounting should occur within the same financial reporting.

Asked Sep 17 2019 in Business by clover. Definition of Accrual Basis of Accounting. Accruals Concept of accounting requires that income and expense must be recognized in the accounting periods to which they relate rather than on cash basis.

Accrual concept convention principle of accounting defines and states that incomes when earned and expenses when incurred rather than when cash is received or paid. Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs versus when payment is received or made. Accrual represents revenues and expense which are not recorded on a firms balance sheet.

Thus economic events are recorded irrespective of the dates on which any. Accrual basis accounting transactions that affect a companies financial statements are recorded in the period in which the event occurred even if cash was not exchanged. The Accrual basis is the accounting principle that use to recognize and record accounting transactions or events in the financial statements regardless of its cash flow.

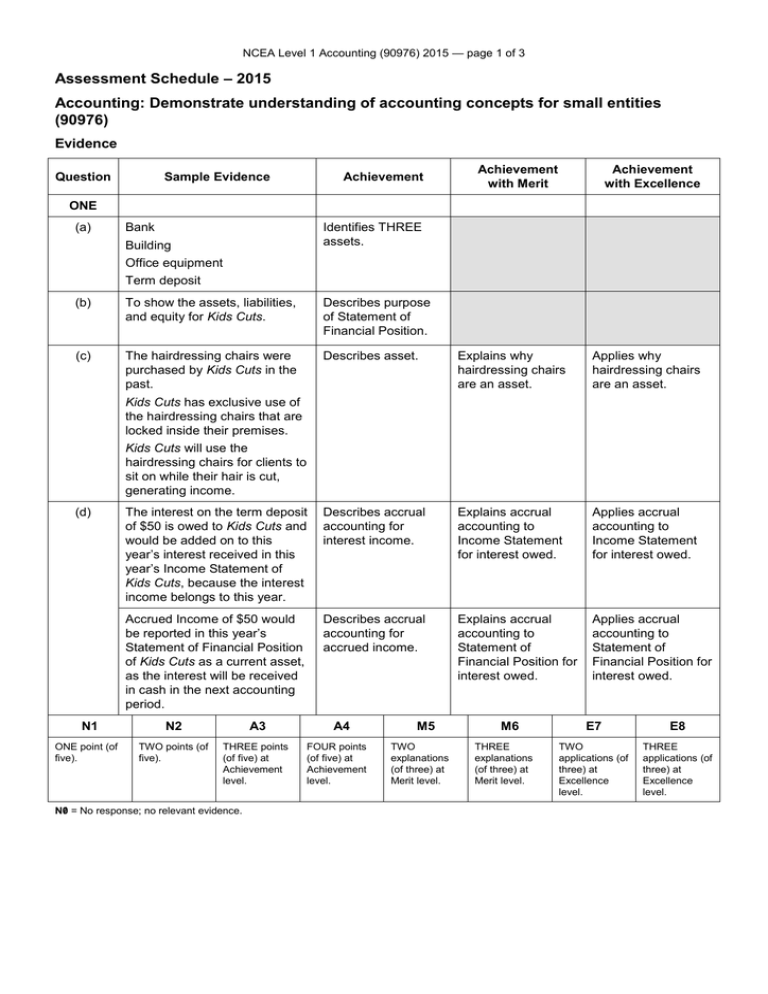

Solved In The Context Of Proper Accounting Systems Which Of Chegg Com

The Income Statement Income Statement Bookkeeping Business Accounting

No comments for "What Best Describes Accrual in the Context of Accounting"

Post a Comment